CROWDFUNDING

Crowdfunding means to fund a project by raising money from a large number of people. Crowdfunding is a form of alternative finance. Several models of crowdfunding exist. They can be classified in two main categories, which differ in respect to the relationship between the funders who provide financial resources and those that receive the funds to implement a project.:

- In donation crowdfunding, the contributions of the funders are not connected to a financial return;

- In investing crowdfunding, financial instruments are sold which can be shares, shares in assets or returns depending on the financial performance.

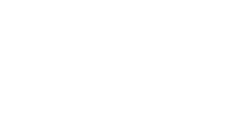

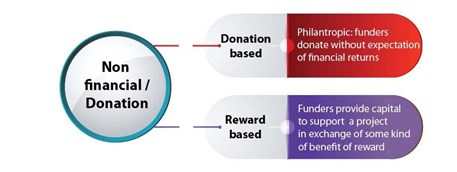

Figures 10 and 11 below show an overview of major crowdfunding models:

Fig 10: Overview of major non financial/donation crowdfunding models

Fig 11: Overview of major financial/investing crowdfunding models

Non-financial crowdfunding can be calls for donations which are requested without any financial returns. They rely on altruistic motives. This includes donations for charitable or public interest causes. A variation of this model is civic crowdfunding, where citizens’ contributions are used to finance public works or services for communities.

Another form of non-financial crowdfunding is the reward based model where individuals provide capital to support a project in exchange for some kind of benefit or reward.

In lending crowdfunding funders receive usually a fixed rate of interest. Lending can be peer-to-peer or peer-to-business. With equity crowdfunding funders receive an equity instrument or a profit sharing arrangement. A third model is the royalty based model, where funders receive a royalty derived from intellectual property developed by the fundraising company.

Non-financial crowdfunding can be pure calls for donations which are given without expectation of any financial returns or benefit, thus relying on altruistic motives. Typical donation campaigns are run for charitable or public interest causes. A declination of such model is civic crowdfunding, where citizens’ contributions are used to finance public works or services for communities.

Another form of non-financial crowdfunding is the reward based model where individuals provide capital to support a project in exchange for some kind of benefit or reward.

With lending crowdfunding funders receive a debt instrument that specifies future terms of payment, usually a fixed rate of interest. Lending platforms can be peer-to-peer or peer-to-business. With equity crowdfunding funders receive an equity instrument or a profit sharing arrangement. A third less common model which is gaining traction more recently is the royalty based model, where funders receive a royalty interest derived from intellectual property of the fundraising company.

PUBLIC-PRIVATE PARTNERSHIP (PPP)

Public-private partnership (PPP) is a model to fund public infrastructure projects, e. g.a new telecommunications system, roads, sewers, waste water treatment, airport or power plant in which public partners and private partners cooperate The public partner is represented by the public organisation, e. g. government at a local, state and/or national level. The private partner can be a privately-owned business, public corporation or consortium of businesses. Depending on different roles in owning and maintaining assets, different PPP models exist:

- Design-Build (DB): The private-sector partner designs and builds the infrastructure to meet the public-sector partner’s specifications, often for a fixed price. The private-sector partner assumes all risk.

- Operation & Maintenance Contract (O & M): The private-sector partner, under contract, operates a publicly-owned asset for a specific period of time. The public partner retains ownership of the assets.

- Design-Build-Finance-Operate (DBFO): The private-sector partner designs, finances and constructs a new infrastructure component and operates/maintains it under a long-term lease. The private-sector partner transfers the infrastructure to the public-sector partner after the expiry of the agreement.

- Build-Own-Operate (BOO): The private-sector partner finances, builds, owns and operates the infrastructure component in perpetuity. The public sector partner’s constraints are stated in the original agreement and through on-going regulatory authority.

- Build-Own-Operate-Transfer (BOOT): The private-sector partner is granted authorization to finance, design, build and operate an infrastructure component (and to charge user fees) for a specific period of time, after which ownership is transferred back to the public-sector partner.

- Buy-Build-Operate (BBO): This publicly-owned asset is legally transferred to a private-sector partner for a designated period of time.

- Build-lease-operate-transfer (BLOT): The private-sector partner designs, finances and builds a facility on leased public land. The private-sector partner operates the facility during the land lease period. After this period, assets belong to the public-sector partner.

- Operation License: The private-sector partner is granted a license or other expression of legal permission to operate a public service, usually for a specified term (this model is often used in IT projects).

- Finance Only: The private-sector partner, usually a financial services company, funds the infrastructure component and charges the public-sector partner interest for use of the funds.

Guidelines for successful Public-Private Partnership (European Commission, March 2003): these guidelines are designed as a practical tool for PPP practitioners in the public sector faced with the opportunity of structuring a PPP scheme and of integrating grant financing.

Resource Book on PPP Studies (European Commission, June 2004): the Resource Book is structured to present detailed case studies in the following sectors: water/wastewater, solid waste management and transport.

When preparing or reviewing PPP project documents, it is useful to have access to checklists of issues to consider: https://ppp.worldbank.org/ppp/overview/ practical-tools/checklists